Heard about virtual cards but have no clue what they are? Or just need a bit more information before signing up? Let’s clear up any confusion.

A virtual card is a digital payment card linked to your debit or credit card that does not reveal any of your personal details when you make purchases at merchants or services.

It’s a popular way to shop privately and securely because you get your items but merchants and bad actors don’t get your data.

How does a virtual card work?

- A virtual card is digital, so it sits on your device, not in your physical wallet.

- It is linked to your debit or credit card, but it actually has its own card number, CVV and expiry date. It’s like a proxy for the debit or credit card you link to the virtual card.

- You can use it online or over the phone or anywhere you need to give someone your credit card number.

- Since the virtual card has its own details, your details are safe: the merchant doesn’t get your data and neither do data brokers or criminals. Even your transaction details (what you bought and where) are kept private from your bank.

- The virtual card doesn’t have its own balance. Charges made on it are forwarded directly to your linked card (i.e. debit or credit card).

- You can use this type of a card for a one-off payment or for all your purchases.

- You can close a virtual card at any time to stop unwanted charges.

What makes MySudo virtual cards* so good?

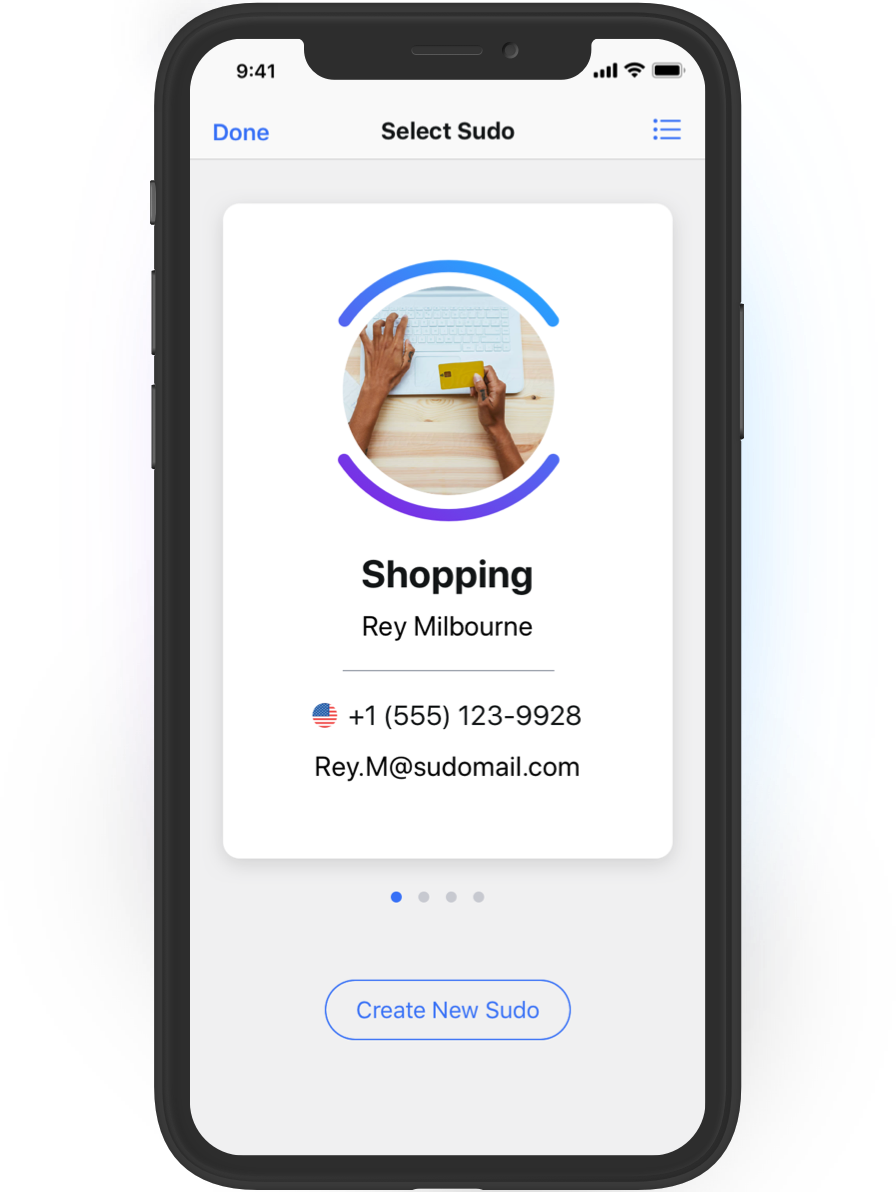

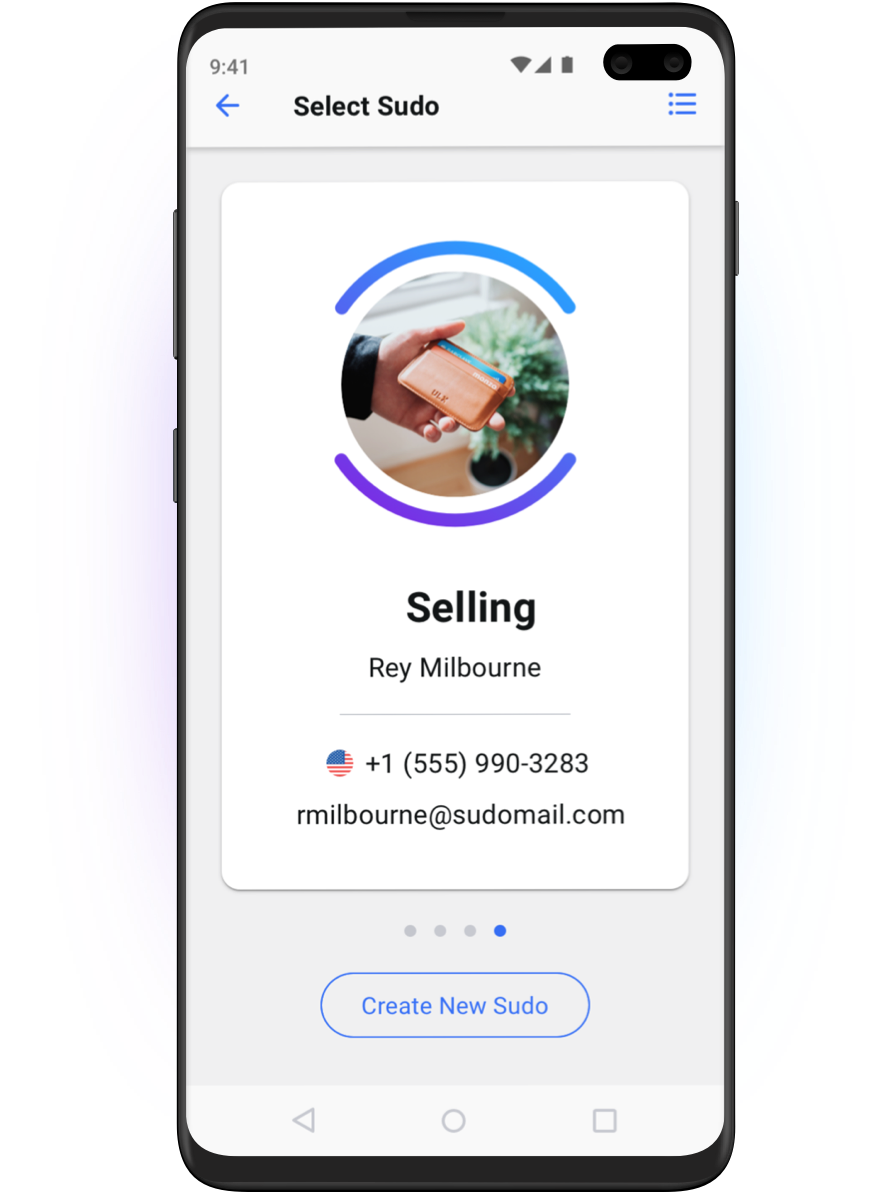

MySudo is the world’s only all-in-one privacy app, so it makes sense that it offers virtual cards* to users as one of many privacy and cyber safety features.

Here’s what makes these digital payments a great choice:

- Combined with the private Sudo email and phone number, a MySudo virtual card lets you completely compartmentalize (silo) your spending across purposes. This organizes your spending and disaggregates your digital exhaust to protect you against data breaches, data brokers and criminal activity. It also means you match the virtual card use to your Sudo use, keeping some virtual cards for a long time (e.g. to book air travel) and others for a very short time (e.g. to buy an item from a website you suspect might be sketchy).

Not sure how MySudo works? Watch this or read this.

Learn how to make best use of your Sudos.

- MySudo virtual cards give you a choice of funding source for your virtual cards – link them to either a debit or credit card.

- Detailed transaction history is visible to you in the MySudo app but not on your bank statement, where transactions appear only as ‘MySudo transaction’, to protect your privacy and render the information less valuable to organizations that sell your personal data.

- You can cancel a MySudo virtual card at any time without affecting the rest of your Sudo’s functionality. You have a limit of one active virtual card per Sudo, so if you cancel one of your Sudo virtual cards, you can create another one.

Why are virtual cards so popular?

Virtual cards are considered the most private and secure way to make purchases at merchants or services because they shield your personal and financial information from being shared, sold or stolen. The more places you leave your details, the higher the chance you’ll be hit by an avalanche of spam at best and a data breach or criminal fraud scam at worst.

The FTC reports Americans lost $8.8 billion to fraud in 2022. Don’t let that happen to you.

Learn more about these digital payments on our blog or FAQ section.

* Currently only available on iOS and in the US. Android and more locations coming soon