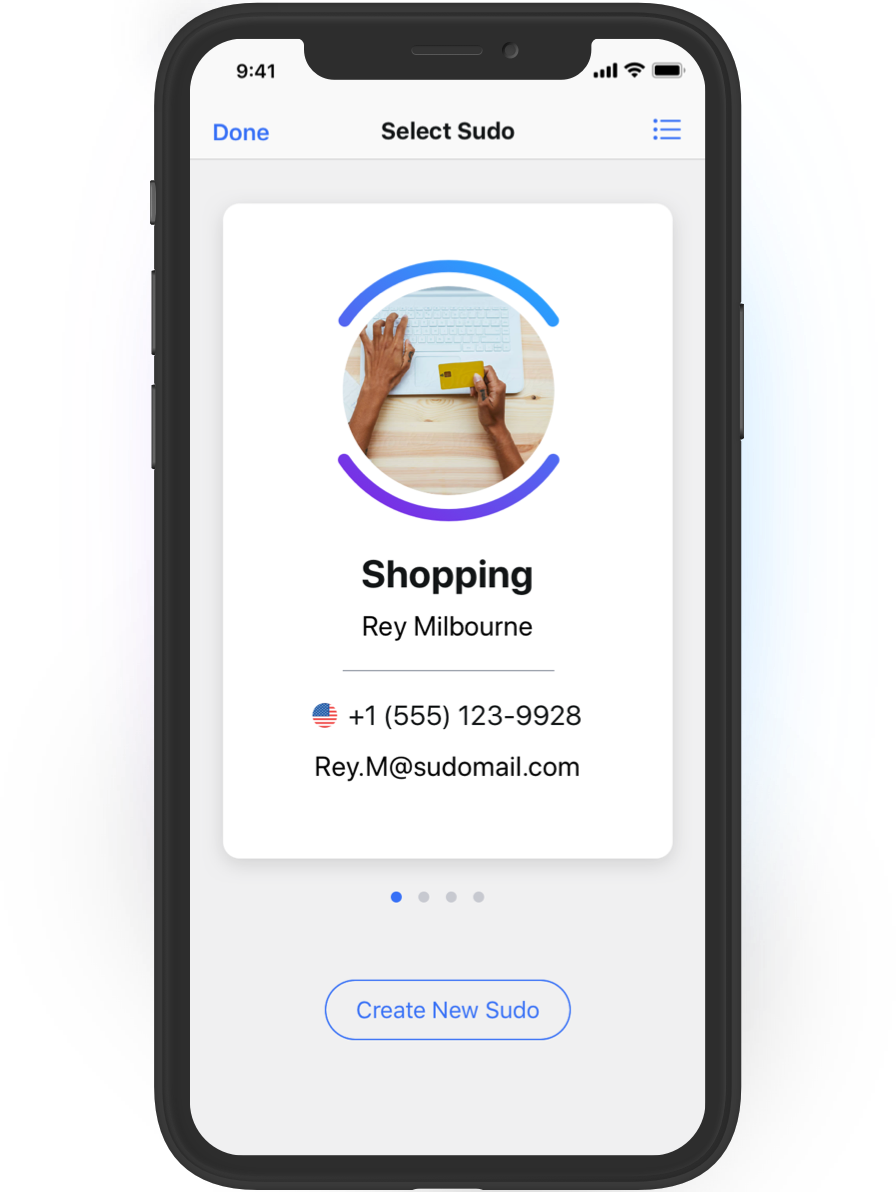

A MySudo virtual card is like your personal credit or debit card, with far less risk.It’s not associated with your personal identity or your personal credit or debit card number, so you’re protecting your private information and limiting your financial risk. If you haven’t used MySudo virtual cards yet, you can learn about them in this article.

One of the steps in setting up virtual cards is to add one of your existing payment methods to fund purchases with your virtual cards. We must ask you for a funding source for your MySudo virtual cards because your virtual card represents, but works separately from, your regular credit or debit card. It’s a financial avatar that goes online in place of you and your regular credit or debit card and completes transactions without leaving any trace of your personal information.

You may have initially decided to add your bank-issued credit card as a funding source when you first setup MySudo virtual cards. But did you know that you may also be able to use your regular bank account as a funding source? You can do this by using the debit card linked to your savings or checking account that your bank has provided. Using your bank account with MySudo in this way actually requires that we know less of your personal banking information than if we used a direct debit mechanism such as ACH.

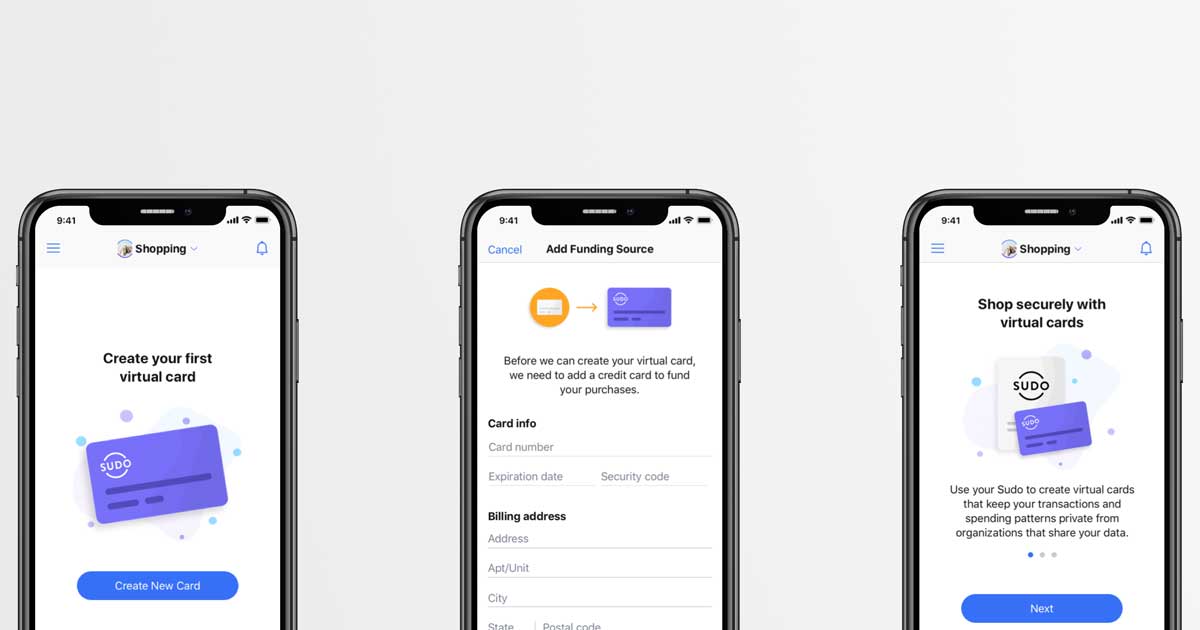

Assuming that you are following the instructions to setup virtual cards and your bank account has a linked debit card, follow these 3 simple steps:

- In MySudo app, go into Settings Virtual Cards.

- Add a new funding source and enter the information associated with the debit card linked to your bank account.

- Create a virtual card and start shopping!

We are glad to give you these choices in how you fund your use of MySudo virtual card (and will release additional funding source options soon).