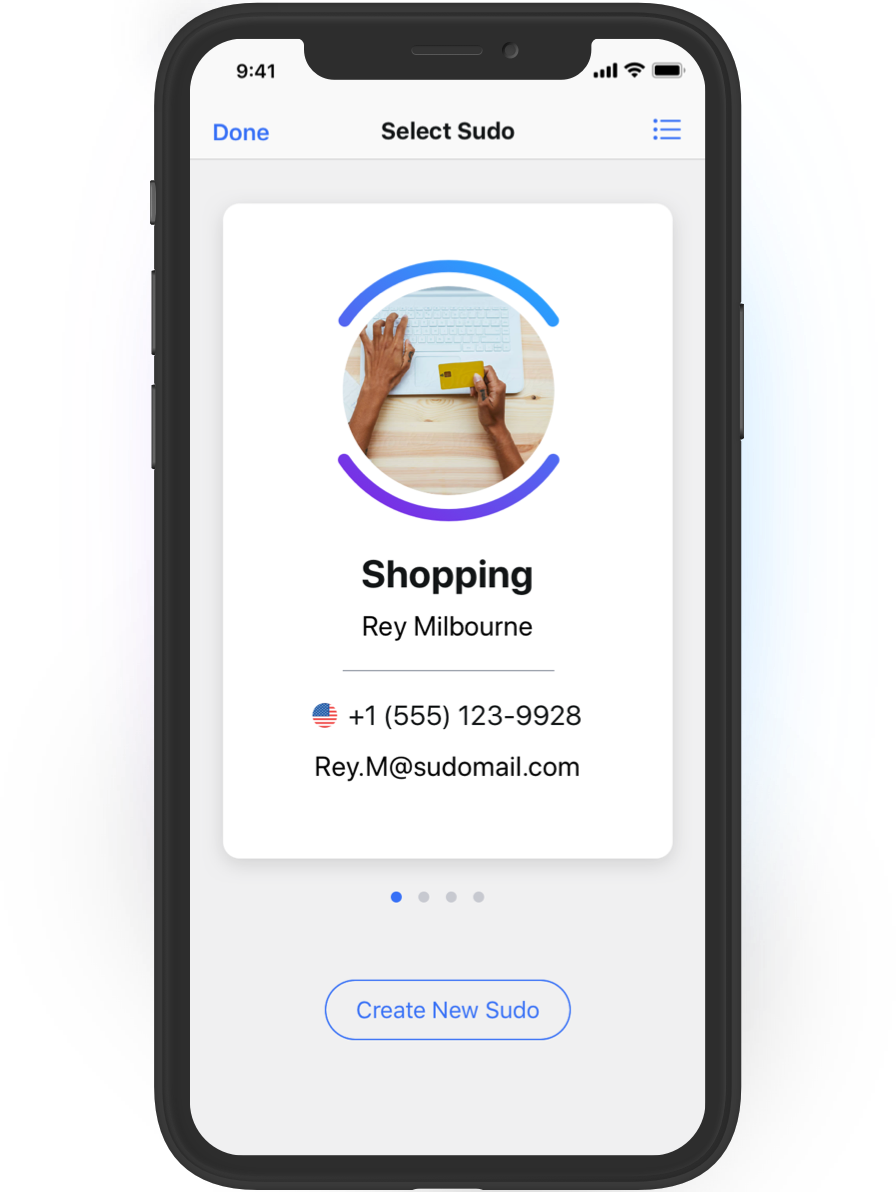

In an earlier article , you learned the six top privacy benefits when you use MySudo virtual cards:

- You stay private online. MySudo virtual cards are not linked to your name, age, address, phone number, SSN, or any other identifying information, so your private data stays private.

- Your spending habits can’t be tracked. The charges you make with your MySudo virtual cards are simply described on your bank statement as ‘MySudo Transaction’, so your spending habits can’t be tracked which means your data isn’t worth much to your bank or the data brokers.

- You keep your money safer. Each MySudo virtual card represents, but works separately from, your personal credit or debit card, so even if a virtual card is part of a data breach, you really limit your risk.

- You choose the funding source. You may have decided to add your bank-issued credit card as a funding source when you first setup MySudo virtual cards. But did you know that you may also be able to use your regular bank account as a funding source? You can do this by using the debit card linked to your savings or checking account that your bank has provided. Learn more

- You can set up a card in seconds. A MySudo virtual card takes a minute to create and only seconds to cancel or replace. No bank queues or forms—just a few taps in the app.

- You can use MySudo virtual cards just about anywhere in the US. We’ll add more countries and currencies soon.

- You reclaim control. MySudo gives you control over your personal information. Privacy matters, and at Anonyome Labs we don’t think being private should mean opting out of online services or hiding from the world. We empower you to be able to determine what information you share, and how, when, where and with whom you share it. This includes your financial details.

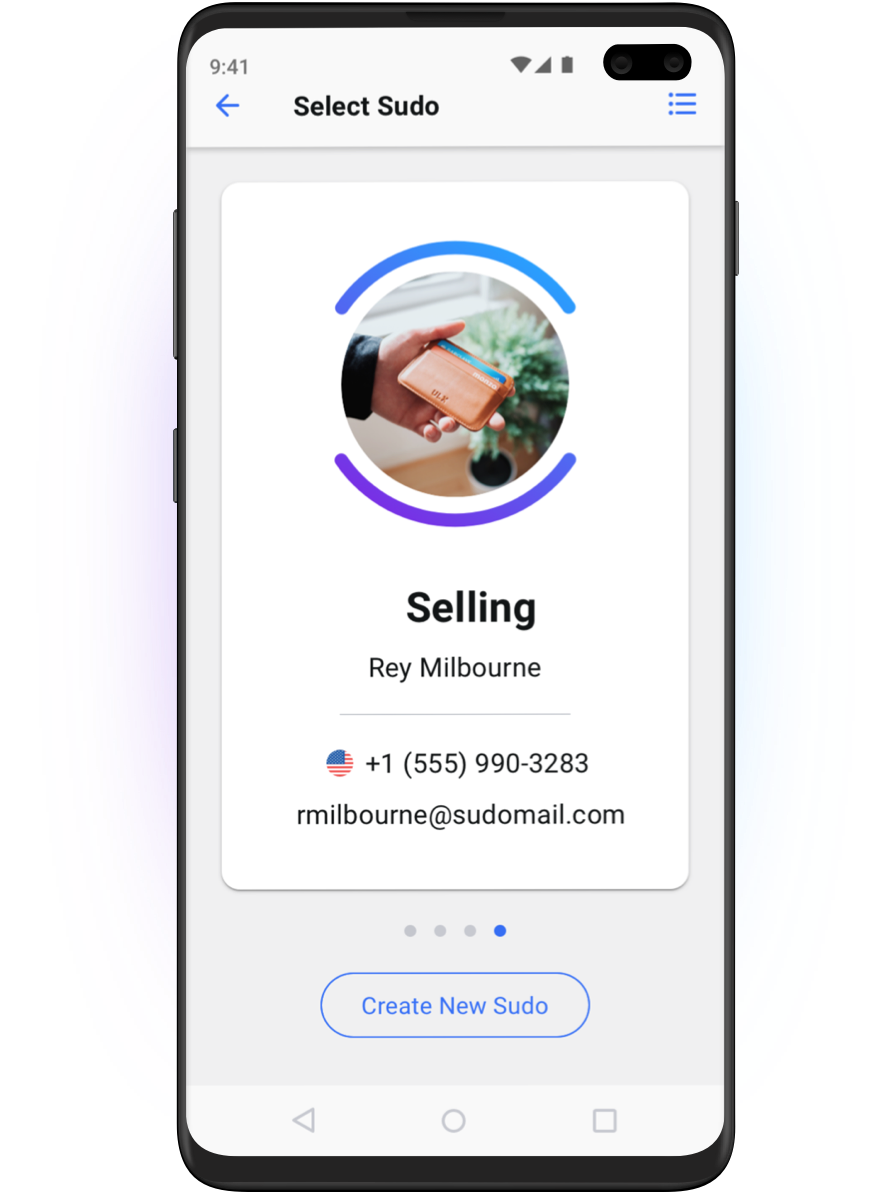

These strong privacy benefits are clearly superior to those offered by a bank-issued credit or debit card. But what about when your bank offers you its own virtual card product? How does the privacy of MySudo virtual cards stack up against a bank-issued virtual card?

The Privacy Problems of Bank-Issued Virtual Cards

A bank-issued virtual card has some privacy benefits. If you use the virtual card on a site that is breached or infected with card skimming malware, your primary credit card number remains safe. But, a bank-issued virtual card and its transactions do not remain private to your bank itself. That’s where the privacy problems lie. Banks have a good reputation for high standards of security (confidentiality, integrity and availability). But security and privacy are not the same thing.

Banks themselves use your transaction history to decide which additional products they will try to offer you. Banks will also sell your data to third parties, who may enrich it and sell it on to other companies—surveillance capitalism at its worst.

Your financial information is important to data brokers such as Acxiom, and banks share information with those types of companies as well. Did you know there are 4000+ data brokers in the United States where your data may be already? Financial data brokers such as Yodlee claim that they make data private through a technique known as anonymization, though when not implemented properly, the data can be re-identified and associated with people.

How MySudo Virtual Cards Increase Your Privacy

MySudo Virtual Cards keep your transactions private from your bank, and therefore beyond the reach of your bank and the data brokers and other third parties to which your bank sells your transaction history. As we state in our Privacy Policy, we do not sell or share your transaction history with any third party, beyond what is required to process the transactions that you make with the virtual cards.

Privacy is about control, not secrecy. MySudo virtual cards give you exactly that—greater control over how your transaction data is used (and misused) by your bank and its data broker partners.